There is more than one reason to be cautious about 2024, with a plethora of events that bearish investors could be worrying about, including a hard landing, a recession or a possible return of inflation.

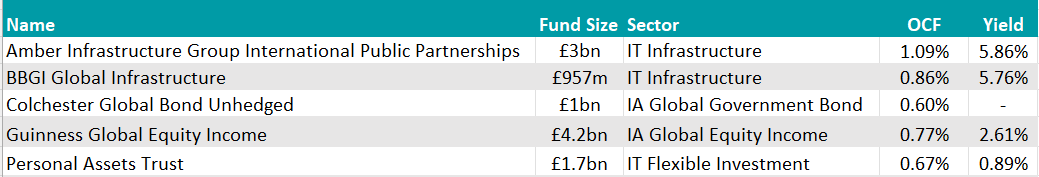

Below, Trustnet collected five expert fund picks intended for investors that are wary of taking too much risk in the new year.

Personal Assets Trust

Bestinvest director Jason Hollands chose the multi-asset Personal Assets Trust managed by FE fundinfo Alpha Manager Sebastian Lyon, which is known for its emphasis on capital preservation.

Performance of fund vs sector and index over 1yr

Source: FE Analytics

“The trust won’t blow the lights out in a bull market but it does have a very strong record of protecting assets in down markets,” said Hollands.

“It is very defensively positioned currently, with equity exposure at 24% – one of the lowest levels for many years.”

The equity portfolio is invested in blue-chip names such as consumer brands companies Unilever and Nestle, payments firm Visa, tech giant Microsoft and drinks maker Diageo. Within fixed income, US Treasury Inflation Protected Securities are the largest allocation at 28%, accompanied by a 3% holding in UK index-linked bonds. About 23% is held in short-dated government bonds (split between US treasuries and UK gilts) and gold-related investments make up 11% of the portfolio.

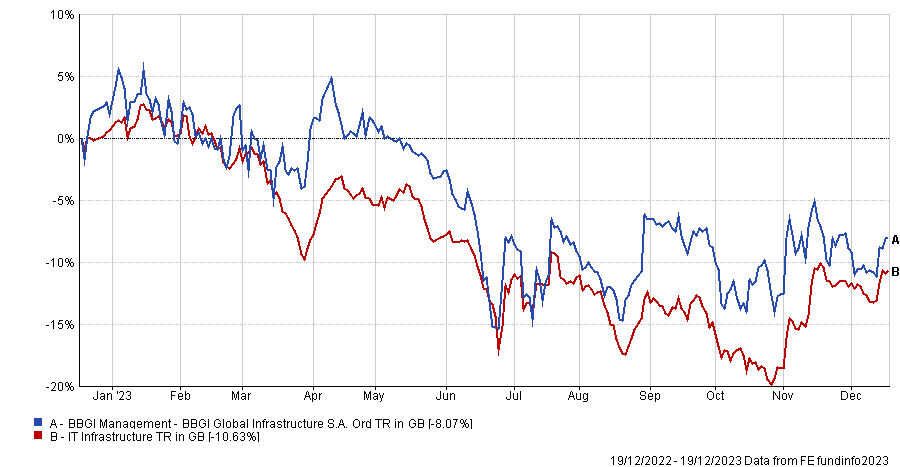

BBGI Global Infrastructure

Another option for investment trust aficionados came from David Hambidge, co-head of Premier Miton Investors’ multi-manager team, who picked BBGI Global Infrastructure. It invests in infrastructure investments such as hospitals, schools, prisons and roads.

Performance of fund vs sector and index over 1yr

Source: FE Analytics

“The focus is on owning completed or near-completed projects with long-term contractual revenues based on their availability for use, rather than their volume of use. This means the underlying cash flows have limited sensitivity to demand risk,” he explained.

“Although one of the managers has announced he is retiring in 2024, we believe that BBGI has every chance of delivering a strong total return for investors over the next few years and, like so many closed-ended income-producing funds, should benefit from an easier monetary policy which looks like is coming in 2024.”

In the meantime, investors “are being paid to wait for share price recovery” with a yield of just under 6%.

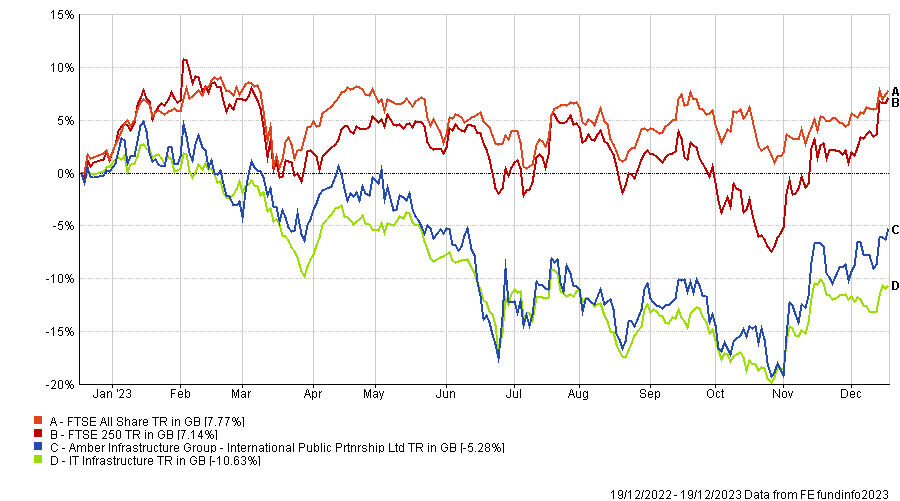

International Public Partnerships

Closing the investment-trust section is Deutsche Numis’ director and head of investment companies research Ewan Lovett-Turner, whose pick was International Public Partnerships.

Performance of fund vs sector and index over 1yr

Source: FE Analytics

“We believe this is an attractive investment for investors concerned about the economic outlook, particularly with the trust trading on a 15% discount to net asset value (NAV),” he said.

The trust generates “strong” cash flows and has a 6.1% yield, which is covered 1.2x from a portfolio of infrastructure assets including in the education, electricity transmission and transport gas distribution sectors.

“The manager has demonstrated strong origination of assets to build an interesting portfolio including the Thames Tideway Tunnel super sewer as well as the significant exposure to offshore transmission cables that connect wind farms to land,” Lovett-Turner added.

“The strategy benefits from strong visibility of cashflows, with predominantly government-backed income streams and high levels of inflation linkage. “

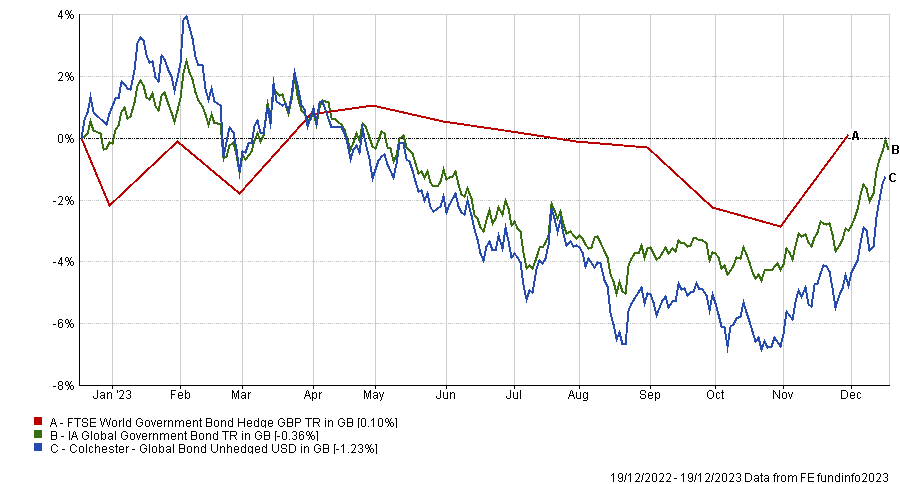

Colchester Global Bond

In the open-ended universe, Tom Stevenson, investment director at Fidelity Personal Investing, suggested the $1.6bn Colchester Global Bond fund.

It invests in low-yielding and low-risk investments, which are often sought after by investors in times of global crises or when fears of recession take hold.

Performance of fund vs sector and index over 1yr

Source: FE Analytics

“The fund will usually be a helpful insurance policy against such events and can be used as a defensive component in a wider portfolio,” Stevenson said.

“It lends money to governments globally, mostly in developed markets but smaller amounts in emerging markets too. These investments tend to be low risk (since governments are the most reliable creditors) and income received will subsequently be quite low, although this does not mean that the fund will always avoid losses if interest rates go up.”

Colchester is a specialist house that almost entirely focuses on lending money to governments. It is also an independent firm, majority-owned and controlled by its employees.

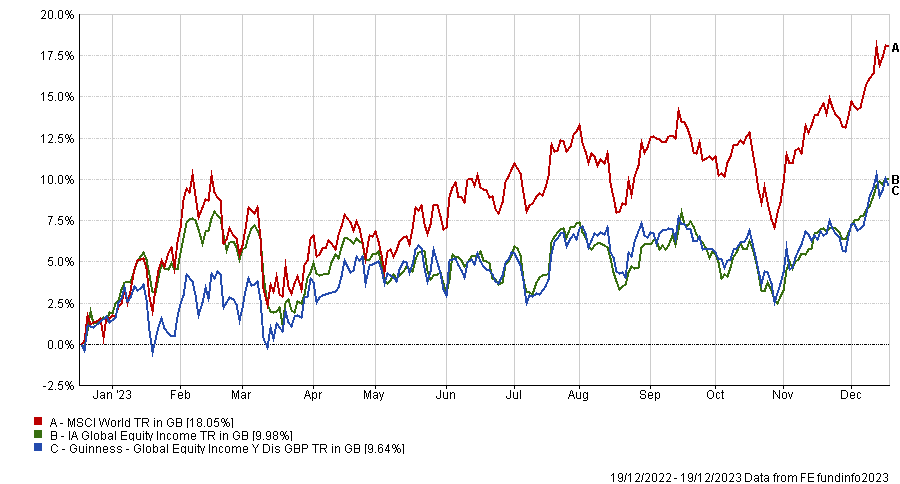

Guinness Global Equity Income

While money market and bond funds might look attractive, there’s no need to abandon equity funds altogether, according to Shannon Lancaster, fund manager at Ravenscroft Group.

The power of compounding means that reinvesting dividend income over time can significantly add to overall returns even during periods of lack lustre economic growth, she said, which is why she selected the Guinness Global Equity Income fund.

Performance of fund vs sector and index over 1yr

Source: FE Analytics

“It has been running since December 2010 and seeks to generate income and growth investing in companies that pay sustainable dividends. It would work well in a diversified portfolio of both equity and bond funds,” she said.

“The team looks for high return on capital and consistently growing dividends. Its approach means that they generally prefer businesses that have weathered multiple economic environments and have consistently generated returns above their cost of capital.”

Source: FE Analytics